Up to 23.5 million Americans, seven percent of the population, are afflicted by these diseases caused by the body’s immune system malfunctioning and attacking healthy cells. In fact, autoimmune diseases — and there are about 80 of them — have surpassed both cancer (in all its forms) and heart disease in prevalence.

Not surprisingly, autoimmune diseases represent a fertile area of research for life science companies, and these companies are growing strong in raising capital and advancing in clinical trials.

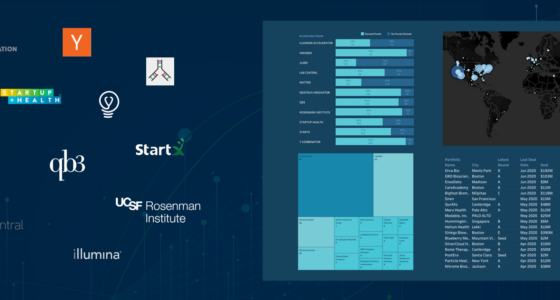

CipherBio PRO goes deep into the autoimmune disease sector.

When you narrow the data to companies that received funding in 2019, 2020, and 2021 Q1, the autoimmune platform reveals 110 companies, 322 investors, 416 approaches and $5.8B in invested capital. Additionally, these companies are separated into their respective clinical phases (updated quarterly, Q1 2021).

.

CipherBio PRO launched for U.S. investors on April 7, and will soon be available to investors, founders and VCs globally.

Over half of the companies are in preclinical trials, showing the majority of these companies have just in recent years begun their quest at combating autoimmune conditions.

Last year, we also saw the biggest autoimmune deal, which was also the sixth biggest M&A deal of 2020: Sanofi’s $3.7 billion acquisition of Principia Biopharma Inc., a company with lead investors Sofinnova Ventures and New Leaf Venture Partners. Principia has two autoimmune drugs in Phase 3 clinical trials, one for multiple sclerosis (MS) and another for pemphigus, which is a rare skin disorder.

Last year, we also saw the biggest autoimmune deal, which was also the sixth biggest M&A deal of 2020: Sanofi’s $3.7 billion acquisition of Principia Biopharma Inc., a company with lead investors Sofinnova Ventures and New Leaf Venture Partners. Principia has two autoimmune drugs in Phase 3 clinical trials, one for multiple sclerosis (MS) and another for pemphigus, which is a rare skin disorder.

Following closely behind that largest autoimmune deal, was Horizon Therapeutics’ $3 billion acquisition of Viela Bio in early 2021. Viela Bio is working on treatments for a variety of autoimmune diseases, including rheumatoid arthritis (RA), systemic lupus erythematosus (SLE), Sjogren’s syndrome and myasthenia gravis.

Following closely behind that largest autoimmune deal, was Horizon Therapeutics’ $3 billion acquisition of Viela Bio in early 2021. Viela Bio is working on treatments for a variety of autoimmune diseases, including rheumatoid arthritis (RA), systemic lupus erythematosus (SLE), Sjogren’s syndrome and myasthenia gravis.

Interested in the top autoimmune disorder?

MS, the chronic central nervous system disorder, is the top autoimmune indication in investment amount, accounting for $6.7 billion in investments from 2019 to 2021.

To round out the top three autoimmune indications: RA and then ulcerative colitis. These top three indications are being worked on by 55 companies that received funding from 2019-2021 Q1 and expand across every stage of clinical trials. Narrowing in, we discover the companies with the greatest investment rounds that are in phase 2 trials for these top three indications.

For MS, Pipeline Therapeutics topped the list with an $80M Series C in Feb 2021 invested by Perceptive Advisors, Franklin Templeton, Casdin Capital, Samsara BioCapital, Suvretta Capital, and Red Tree Venture Capital.

For MS, Pipeline Therapeutics topped the list with an $80M Series C in Feb 2021 invested by Perceptive Advisors, Franklin Templeton, Casdin Capital, Samsara BioCapital, Suvretta Capital, and Red Tree Venture Capital.

Working on ulcerative colitis, as well as Crohn’s disease, Connect Biopharma had the greatest round with a Series C financing round led by RA Capital Management. Soon after the Series C, Connect Biopharma went public in March 2021 with an $191M IPO.

Working on ulcerative colitis, as well as Crohn’s disease, Connect Biopharma had the greatest round with a Series C financing round led by RA Capital Management. Soon after the Series C, Connect Biopharma went public in March 2021 with an $191M IPO.

Coming out on top for Rheumatoid, Cambridge, UK based Immune Regulation, raised a $53.4M Series B led by 5Y Capital (formerly known as Morningside Ventures).

Coming out on top for Rheumatoid, Cambridge, UK based Immune Regulation, raised a $53.4M Series B led by 5Y Capital (formerly known as Morningside Ventures).

While these diseases, along with all autoimmune conditions, involve vastly different symptoms and affect different parts of the body, they share in root cause: a malfunction of the immune system that researchers are working to combat.

And autoimmune disease work within the life science industry is only increasing. It has already gained nearly $7B in 2021 across 29 deals, and that includes a $273M IPO.

Importantly, the research into treatments provides an antidote to life with autoimmune disease: hope.

Learn more about CipherBio PRO and how it can help you make investment and funding decisions.

Already using CipherBio PRO?

Thank you, and we want to hear about it. Tell us what you are finding interesting as you dig into the data.

Give us a call at

1-888-420-4752