We recently gave a tour of CipherBio Pro to a U.S. VC, who wanted to see in five minutes how the platform could provide real-time data to support investment decisions.

CipherBio PRO launched for U.S. investors on April 7, and will soon be available to investors, founders and VCs globally.

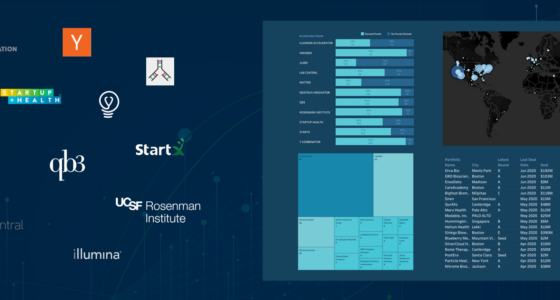

CipherBio Pro digs deep into nearly 9000 life science companies, 4600+ investors, and over $325 billion in invested capital. Each data point can be sliced and diced at the clinical stage of the deal — from the earliest pre-clinical state to late-stage trials and the pre-regulatory approval stage.

Five minutes?

It took seconds.

On this day, we plunged into Neurology: ~220 companies, 450+ investors, $20.4B in invested capital, 310 indications, 654 approaches.

The investor wanted to look at epilepsy. More than $1.9B invested across 15 deals.

He then wanted to see all the companies with phase three clinical trials. There was one: Arvelle Therapeutics, with $223M in funding.

The biopharmaceutical firm, based in Switzerland, is relatively new and has been busy. It was founded in 2018, had quickly raised $200M, and had just been sold in early January to Italy’s Angelini Pharma for nearly $1B. A barely three-year-old company sold for nearly $1 billion.

Answers and insights in seconds.

His mind was blown. We believe his exact quote was, “This is incredible!”

We get it. Our minds are blown every time we burrow into the platform we’ve poured ourselves into creating. We track companies by sectors, clinical phases, locations and funding. We keep tabs on investors and focus on top indications and clinical approaches. Think of CipherBio PRO like a Bloomberg terminal exclusively for life sciences founders and investors — and it’s the only one of its kind in the world. Each data point yields new questions and answers, new insights and opportunities.

Neurology in particular is also blowing our minds, and here are a few reasons why.

- Neuro is a hot area for deal-making right now; just witness newcomer Arvelle’s success. Money flow into the field has seen an uptick in the past decade. And U.S.-based neuro companies in the 10 years that ended in 2018 came second only to cancer companies in both venture capital investment and initial public offerings.

- Within neuro, we expected Alzheimer’s disease to be the most active area. But CipherBio PRO debunked our own hypothesis. While Alzheimer’s has more deals, Parkinson’s disease has more money. For now. The data points are always changing.

- But you know what has double the number of companies and funding as Parkinson’s? The answer: companies developing treatments and cures for orphan and rare diseases. Orphan/rare has twice as many companies and double the deals of practically every other neuro indication. And orphan/rare has companies with therapies at every stage of development – preclinical, phase one, phase two and phase three.

We could go on and on. Our minds are blown each and every day we look at the data!

Learn more about CipherBio Pro and how it can help you make investment and funding decisions.

Already using CipherBio Pro?

Thank you, and we want to hear about it. Tell us what you are finding interesting as you dig into the data.

Give us a call at

1-888-420-4752