Doctors, scientists, health officials, world leaders and regular citizens around the globe breathed a collective sigh of relief late last year as vaccines to combat COVID-19 became a reality.

The end of 2020 and beginning of 2021 presented three approved vaccines in the U.S., and distribution of those vaccines began shortly after their validation. While most of the attention went to Pfizer, Moderna, Johnson & Johnson, and other big pharmaceutical companies behind the development of vaccines, many smaller, early stage life science companies contributed to the efforts and continue to do so.

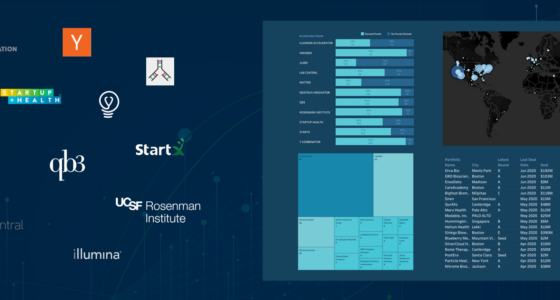

CipherBio PRO provides insight into these smaller, early stage companies, zeroing in on private firms working on COVID-19 that received funding in 2019, 2020 and 2021 Q1. This reveals 95 companies, 265 investors, $10.6B in invested capital and scientific approaches when all funding events selected, including IPOs and acquisitions.

Interested in the biggest deal in 2020?

CureVac comes out on top with a $640M Series F backed by the German government, GlaxoSmithKline, Qatar Investment Authority and the company’s existing investors. The German-based CureVac didn’t stop there. Less than a month later, the company announced a $213M IPO that would take it public.

CureVac comes out on top with a $640M Series F backed by the German government, GlaxoSmithKline, Qatar Investment Authority and the company’s existing investors. The German-based CureVac didn’t stop there. Less than a month later, the company announced a $213M IPO that would take it public.

Before the pandemic, CureVac showed promising results in fighting infectious diseases. Its approach: mRNA vaccines, the same technology used in Moderna and Pfizer’s COVID-19 vaccines. CureVac’s vaccine is now in phase 3 trials, and Bayer and GlaxoSmithKline have jumped in to help manufacture CureVac’s vaccine in hopes of upcoming distribution.

When the fight against pandemic began, companies whose existing technology platforms could be applicable in this fight shifted their focus to COVID-19, and some, like CureVac, prevailed in their attempts.

Another one of these companies is Oncoimmune, Maryland-based biotech working on biopharmaceuticals for inflammatory diseases. The company’s lead molecule, CD24Fc, modulates the immune response to a series of inflammatory diseases.

Another one of these companies is Oncoimmune, Maryland-based biotech working on biopharmaceuticals for inflammatory diseases. The company’s lead molecule, CD24Fc, modulates the immune response to a series of inflammatory diseases.

At the start of 2020, when COVID-19 patients began to overwhelm hospitals, Oncoimmune started its research to see if CD24Fc had the potential to help those with severe cases. The company’s research showed promising results, and a $56M Series B Round led by HM Capital in September 2020 accelerated its testing to a phase 3 clinical trial. Two months later, Merck acquired Oncoimmune for $425M and gained control of CD24Fc for severe COVID-19 patients.

Not only has COVID-19 revolutionized vaccine and treatment research, but it has also fueled diagnostic companies. Take Cue Health. It began 2020 as a health technology company and ended the year with an FDA-approved and government-backed COVID-19 molecular diagnostic test.

Not only has COVID-19 revolutionized vaccine and treatment research, but it has also fueled diagnostic companies. Take Cue Health. It began 2020 as a health technology company and ended the year with an FDA-approved and government-backed COVID-19 molecular diagnostic test.

In June 2020, Cue Health raised a $100M Series C funded by Decheng Capital, Foresite Capital, Madrone Capital Partners, Johnson & Johnson Innovation and ACME Capital to support the development and launch of its fast and portable COVID testing platform. Two days later, the company received FDA emergency use authorization, and in October the company received $481M from the U.S. Department of Defense to expand production of its tests. Cue Health’s test has demonstrated 97.8% accuracy, is available in 10 states and has received approval in the E.U.

While vaccine distribution has begun and diagnostics have been approved, COVID-19 isn’t going away. Life will be different. But there is hope, thanks to the attention and dedication of the life science industry. For many, this is their life’s work — and truly a matter of life and death.

To delve into the companies continuing this monumental work, and learn more about CipherBio PRO.

Access CipherBio PRO Learn More

Already using CipherBio PRO?

Thank you, and we want to hear about it. Tell us what you are finding interesting as you dig into the data.

Give us a call at

1-888-420-4752