Co-authored by Matthew Gibbs @CipherBio_gibbs and Nooman Haque SVB Managing Director Global Markets Life Science UK.

The life science industry has been making strides globally, moving toward a radically different future of health. The pandemic gave a new boost of cross-border collaboration, bringing the international aspects of the vibrant industry to the fore. Typically, life science companies and biotech as the most proliferate among them tend to initially focus on the US as the largest and most lucrative market or their market of origin, such as China or Japan (Deloitte, 2019). But as the life science industry evolves globally, new life science hotspot geographies are emerging.

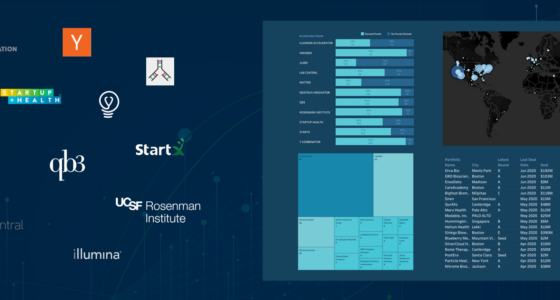

We leveraged the CipherBio database to explore the international life science scene with a special focus on the international investors that are active in the industry to discover what they invest in and how their activities shape the global life science ecosystem. We set out to discover who are the most prominent international investors, where do they invest in and what investment stage they show preference for as well as how they differ from their US peers to help those looking to tap into the international market easier navigate the global life science space.

Key Takeaways

- Data aggregated in the CipherBio database demonstrate that international investors exhibit similar investment behavior to their US peers with respect to the preferred stage of investment, investment destination and life science vertical.

- Notwithstanding the important role of international life science space, the US investors still represent by far the most significant investor class, while the US market plays the most prominent role in the global life science industry.

- Among international destinations, Europe holds the leading place as the research and medical powerhouse of scientific and clinical innovations. Still, the research excellence does not yet translate into patents for new medicines as much as in some other geographies such as the US or China.

- Although European investment opportunities tend to offer favorable return profiles, European investors tend to search for life science ventures outside Europe.

The Most Active International Life Science Investors

Figure 1: Top 9 Most Active International Investors; Source CipherBio May 2020

Figure 1: Top 9 Most Active International Investors; Source CipherBio May 2020

Table 1 represents the list of most active international life science investors since 2019, as per the CipherBio database.

The table is topped by Nextech Invest, a Zurich-based Swiss investment company with an almost exclusive focus on oncology therapeutics, investing in companies in the US and Europe with the potential to create multiple medicines. Nextech Invest closed nine deals since 2019, including $105M Series A of Kronos Bio, a US company developing treatment of oncology targets and $150M Series E of Peloton Therapeutics, a clinical-stage biotech focused on cancer treatments, which was acquired by Merck in a $1.05B deal in 2019.

The runner up is Janus Henderson Ventures, a London-based investment company with eight deals closed since 2019. The most notable among them include $125M Series B of Aligos Therapeutics, a biotech developing treatment of liver diseases and $105M of ALX Oncology Inc., a US-based clinical-stage immuno-oncology company.

The third position is taken by HBM Healthcare Investments, a Swiss-based venture capital firm with the most prominent deals being a $165M Series B of Karius, the US diagnostic company focusing on genomic insights for infectious diseases, and $125M Series B of SpringWorks Therapeutics, a US clinical-stage biotech applying precision medicine to developing drugs for rare diseases and cancer. The latter company made its successful NASDAQ debut in 2020, raising $162M with current valuation at around $1.4B.

The fourth position among the most active investors is split between Sofinnova Partners and BPI France with five deals each since 2019.

Sofinnova Partners is a leading European life science-focused VC firm headquartered in Paris, France, with around $2.3B in assets under management. The biggest Sofinnova’s deal since 2019 is an $82M Series A of Twentyeight-Seven Therapeutics, a company focused on RNA drug discovery.

Bpi France is a subsidiary of Caisse des Dépôts and the French State that operates several venture capital funds investing in life sciences with a focus on biotech and MedTech verticals. The first fund, Innobio, is a €173M ($188.4M) fund launched in 2009 together with nine major pharmaceutical companies to invest in multiple therapeutic areas including oncology, cardiovascular, diabetes, rare diseases, neurology/ophthalmology and inflammatory/infectious diseases. The successor fund, Innobio 2 was launched in 2019, raising €135M ($147M) with a goal to achieve over €200M ($218M). It focuses on France but can invest up to 25% in other European countries. The Rare Diseases Fund is a €50M ($54.5M) venture capital fund launched in 2014 to invest in companies developing therapeutics in the rare disease space. The MedTech Innovation Fund is a €150m ($163M) fund launched in 2014 and fully subscribed by Bpi France, focusing on early to mid-stage MedTech and diagnostic companies. BPI France’s most notable investments in 2019 include Doctolib, a Franco-German online booking platform and management software provider that helps doctors reduce no-show and bring new patients while providing free online service for patients to find a nearby medical practitioner and book appointments. The company was established in 2013 to become the leading cloud service for healthcare scheduling, with BPI France participating in its $170M Series in March 2019, at a $1.13B valuation.

The fifth position among international investors is divided by Forbion, Leaps by Bayer and Wellington Partners with four deals each since 2019.

Forbion is a Netherlands-based venture capital firm focused on investments in the life sciences space managing over €1B ($1.01B) across ten closed-end funds, with offices across the Netherlands and Germany. The most notable investments Forbion made since 2019 include a $120M Series B of Achilles Therapeutics, a UK-based biotech company that develops patient-specific immune therapies for cancer treatment, and $133M financing of AM-Pharma, a Dutch clinical-stage biopharmaceutical company, developing a treatment for acute kidney injury.

Leaps by Bayer is a corporate VC established in 2015 by German pharmaceutical Bayer to invest over $800 million in companies that tackle fundamental breakthroughs in pharmaceutical and agricultural industries. The most notable deals since 2019 include $100M Series B of eGenesis, a US medical devices company revolutionizing transplantation with a multiplexed gene editing platform for the development of human-compatible organs.

Based in Germany, Wellington Partners is a VC company supporting the global ambitions of European innovative early- and growth-stage companies across technology and life science industries. It manages over €400M ($435M) of funds dedicated to therapeutics, MedTech, diagnostics, digital health and biotechnology. The biggest deals since 2019 include $100M Series B of eGenesis, when Wellington Partners participated together with Leaps by Bayer in November 2019.

aMoon is a venture capital firm from Israel specializing in biopharma, digital health and medical technology companies. It closed four deals since 2019, with $80m Series B of Adicet Bio Inc being the biggest transaction (Figure 2).

Founded in 2004, Pontifax is another Israel-based healthcare-focused VC company with over $775M under management and a portfolio of 80 companies that develop breakthrough solutions to substantial unmet needs. Its biggest deal since 2019 is also the $80M Series B of Adicet Bio Inc (Figure 2).

Figure 2: Other International Investors; Source CipherBio May 2020

Figure 2: Other International Investors; Source CipherBio May 2020

Figure 2 further illustrates the expanded table of top 20 life science international investors that also includes names such as Boehringer Ingelheim Venture Fund, EDBI, Syncona Partners LLP, Arix Bioscience, which closed four transactions since 2019 as well as BioGeneration Ventures, CapDecisif Management, Aju IB Investment, High-Tech Gründerfonds, Horizons Ventures and Korea Investment Partners, which closed three deals since 2019.

Life Science Verticals Attracting Most International Investors

Figure 3: Sectoral Breakdown of International Investors’ Activity; Source: CipherBio, June 2020

Figure 3: Sectoral Breakdown of International Investors’ Activity; Source: CipherBio, June 2020

The international investors were by far most active in the biotech vertical with 154 deals since 2019, out of which 128 were closed by VC companies, while corporate VCs closed 15. The second-placed vertical to attract international investors is Digital Health/AI with 61 deals (53 VC investors, six corporate VCs), while medical devices closed 32 and diagnostic 13.

Biotech dominance in the number of deals closed by international investors since 2019 is in line with the general trend observed in the market, as this vertical traditionally contributes most to the total number of deals. This finding is also confirmed by the data from the CipherBio database, which offer more in-depth analytical insights into the sectoral breakdown as well as companies and investors active in each of them.

Geographical Breakdown of International Investors’ Activity

The European life science industry is continuing to exhibit a robust investment surge, particularly in the biotech vertical, driven by success in the clinical work and in the case of mature companies, successful product development (Figure 4).

Figure 4: Investment in European Biotechnology 2017-2019; Source BioWorld, 2020

Figure 4: Investment in European Biotechnology 2017-2019; Source BioWorld, 2020

According to McKinsey’s recent report, three factors are contributing to Europe’s biotech market attractiveness to investors: strong scientific hot spots across geographies, modalities, and therapeutic fields; the status of research and industry expertise powerhouse; and availability of top-notch talent. However, report documents that Europe is moving at two speeds in biotech activity as half of the relevant companies are based in France, Germany, and the United Kingdom, with the last country being home to 35% of all European biotech start-ups since 2012.

Figure 5: Number of Patents Across Geographies; Source McKinsey, 2019

Figure 5: Number of Patents Across Geographies; Source McKinsey, 2019

With 16 of the world’s top 50 universities for life sciences, Europe is the world-class powerhouse for research institutions, medical centers, and hospitals as the underpinning for scientific and clinical innovations. Academic institutions from the continent are publishing approximately the same number of articles in the top ten scientific journals as the United States does and three times as many as China. However, the research excellence does not yet translate into patents for new medicines as the United States develops three times as many and China about nine times as many as Europe (Figure 5). Although European return profiles are favorable compared to the US with pre-money valuations being 30% and structural costs 40% lower, European pharma companies tend to search for innovation outside Europe, most frequently in the US, often overlooking compelling opportunities in their home region. However, European biotechs are poised to attract a broader pool of investors, including those from China, which now account for 3% to 5% of total investment in the European biotech (McKinsey, 2019).

Against this backdrop, the data from the CipherBio database confirms the US dominance of life science space in attracting the attention of international investors (Figure 6), with investments gravitating toward the established life science hubs – the West Coast and clusters in Boston, New York and New Jersey. The US market is followed by Europe, where the most life science activity is centered in the UK, France, Germany and Switzerland.

Figure 6: Investments From International Investors Since 2019; Source CipherBio June 2020

Figure 6: Investments From International Investors Since 2019; Source CipherBio June 2020

The biggest international IPO since 2019 was Genmab, A/S, a Copenhagen, Denmark – based biotech company specializing in the development of differentiated antibody therapeutics for the treatment of cancer, which raised $506M last year in what was marked as one of the biggest IPOs in biotech history.

From locations outside the US, German companies sealed the biggest deals with transactions such as $325M Series B of BioNTech, a Mainz-based immuno-oncology therapeutics company and a $558.7M acquisition of a developer of an inhaled drug delivery platform Breath Therapeutics Inc by Zambon, an Italian pharmaceutical, in the biggest deal in the company’s 111 years long history.

Germany is closely followed by the United Kingdom, with the most prominent deals being $550M Series C of Babylon Health, the UK’s leading digital healthcare service, as well as $240M Series C of CMR Surgical, $130M Series B of Immunocore and $120M Series B of Achilles Therapeutics.

Another location that achieved high-ticket deals is Switzerland, with transactions such as a $570M FerGene deal in which Ferring Pharmaceuticals has spun out its late-phase gene therapy in collaboration with Blackstone Life Sciences to commercialize the bladder cancer drug in the US and internationally. Other notable deals involving Swiss companies include $2.15B Roivant Sciences transaction in which Sumitomo Dainippon Pharma, a leading Japanese pharmaceutical company, paid $3B to buy Roivant’s stake in five of its Vant startups creating a new global pharmaceutical called Sumitovant Biopharma, incorporated as a wholly-owned subsidiary of the Japanese acquirer.

Additional location attracting international investors’ attention is Japan, with a $312M transaction that involves Adaptimmune Therapeutics partnering with Noile-Immune Biotech to co-develop next-generation SPEAR T-cell products to treat cancer.

The newly emerging international life science hubs include Belgium, with seven deals closed by the international investors and Israel, with three deals since 2019.

How Do International Life Science Investors Compare to the US Peers?

Total Number of Deals

International investors were involved in 293 deals since 2019, which is lower compared to the US investors which participated in 468 transactions over the same period (Figure 7). 2020 started strong for both types of investors before the deal activity dried up due to the COVID-19 pandemic, with most of the deals happening before the outbreak spread across the world.

Figure 7: Total Deals Breakdown per Type of Investors; Source: CipherBio June 2020

Figure 7: Total Deals Breakdown per Type of Investors; Source: CipherBio June 2020

Stage of Investments

Data from the CipherBio indicates that international life science investors exhibit investment behavior similar to the US investors when it comes to the investment stage preference.

Early-stage investments attract the most attention of international investors with 39 Seed and 96 Series A investments out of 293 total transactions involving foreign investors since 2019. Series B contributes with 96 transactions, while Series C, D and E account for 42, 16 and 4 deals, respectively (Figure 8).

More specifically, foreign investors are virtually on a par with their US peers when it comes to the seed stage, with 28 and 30 transactions during 2019, respectively and a slightly bigger gap during 2020. However, starting from Series A stage, the gap widens significantly with the US investors charging ahead with almost double the number of transactions in 2019 (124) compared to foreign investors (67). The advantage still holds during 2020, although somewhat less pronounced (41 vs. 29 deals). Series B participation is also stronger for the US investors (104 and 48 deals in 2019 and 2020, respectively) relative to foreign counterparts (62 transactions in 2019 and 34 in 2020).

Figure 8: US and International Investors Comparison Across Investment Stage; Source CipherBio, June 2020

Figure 8: US and International Investors Comparison Across Investment Stage; Source CipherBio, June 2020

As we move towards the later investment stages, the gap appears to be closing indicating that foreign investors tend to center their investments around the late stage investments more than the US peers. Unlike mid-placed investment stages, the absolute disparity between the two types of investors is narrowing across Series D and E, with 27 and 16 Series D transactions conducted by international and the US investors, respectively. Series E participation also exhibits similar characteristics with 4 deals conducted by international investors since 2019 and 8 by the US over the same period.

Geographical Concentration

As depicted by Figure 9, the top location attracting both types of investors during 2019 and 2020 is clearly the US, accounting for almost 70% of foreign investors’ deal activity and around 90% of those from the US.

Other top ten investment locations as per number of deals include the UK, Germany, France and Canada for both investor types.

CipherBio data collected since 2019 documents that the most significant investment destination for international investors is the US with 178 companies receiving funds from this investors type, clearly indicating that the biggest focus of international investors is the US market. The second-ranked location in terms of the number of deals is the United Kingdom, with 21 companies receiving funding from international investors, followed by France (14), Germany (10), Canada (10), Switzerland (7), Belgium (7) and Ireland (5). Outside Europe, most of the activity of life science international investors was centered in Japan (5), South Korea (5), India (4) and Israel (5).

Figure 9: Comparison Between International and US Investors According to Geographical Breakdown of the Investments. Source: CipherBio, June 2020

Figure 9: Comparison Between International and US Investors According to Geographical Breakdown of the Investments. Source: CipherBio, June 2020

Conclusion

International life science industry, although smaller than the US market, plays an important role in the global life science ecosystem with both investors and companies contributing to the field, and among them those from Europe have a particularly prominent presence. Also, with China becoming the second biggest healthcare market in the world, the life science spotlight will increasingly be shifted towards the international stage. Notwithstanding the robust scientific foundation for the growth of life science commercial success in Europe or China having a greater role in the global healthcare market in the world, the US still attracts the most attention from international investors.

Data aggregated in the CipherBio database since 2019 illustrate that international investors share some of the characteristics with their US peers — they both exhibit a clear preference for the US as their investment destination and inclination towards early stage investments, with an almost equal number of Seed stage investments. However, their behavior tends to diverge starting from Series A, where the US investors start to contribute with a significantly higher number of deals compared to their international peers. This tendency continues with Series B before it abates and the two investor types become on a par again with almost equal number of Series E transactions. Other locations attracting most of the investors’ attention — both those from the US and abroad — include the UK, France and Germany, which is a relevant consideration for companies looking to raise funds outside the US.

If you’re interested in finding out more about specific investors — international ones included — or life science companies, make sure to visit the CipherBio free searchable database.