Created at the request of VCs and built according to their specifications, CipherBio Prospect Insights is a tool that investors use to source deals and find prospects on the CipherBio platform. See how this interactive tool looks like and how VCs use it to select, monitor and keep track of prospects and source new life science investments.

Prospect Insights: A Tool VCs Use to Source New Deals

Recognizing the immense value of the data that CipherBio provides on the platform, VCs have approached us with a request to develop an online tool that they will use to source deals based on approaches, indications, geography and stage.

To respond to this request, CipherBio worked with Associates and Principles, those at the forefront of deal-sourcing activities at VC firms, to develop a prospecting tool tailor-made to their specific needs.

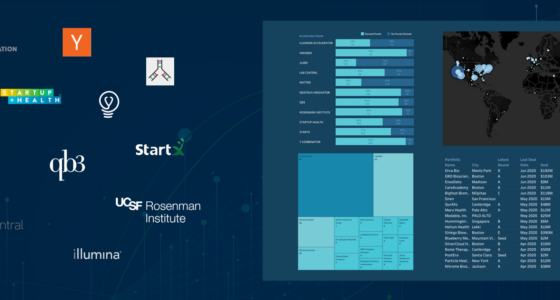

As a result of this effort, CipherBio created Prospect Insights dashboard — a powerful interactive tool that VCs now use to mine the CipherBio database when they search for life science investment opportunities. This tool allows them to see more than 4,000 life science prospects from the CipherBIo database, select those that are of most interest to them and create proprietary shortlists of the prospects they want to monitor, analyze and keep track of.

What follows is the demonstration of how this dashboard looks like, its features and functionalities – presented exactly how VCs have it displayed in front of them – as well as three remarkable new companies that were on the prospect list up until only several weeks ago before they went on to successfully raise Seed and Series A rounds in the current challenging environment.

.

Prospect Insights: A Tool VCs Use to Source New Deals

Meet Life Science Companies That Are in the Process of Raising Seed and Series A Capital

The CipherBio Prospect Insights reveals that currently there are 4,500 of companies that are in the process of raising Seed or Series A capital, majority of which (1,898) are from the Biotech vertical, while there’s an almost equal split between Digital Health/AI (1097) and Medical Devices (1073). As Figure 1 depicts, the Diagnostic vertical is represented with the lowest company count (427).

The information mentioned in the weekly digest newsletter and the insights section should help you tailor a more deliberate communications campaign, after understanding what investors are looking for and their preferences and priorities.

Figure 1: Prospects Across Sectoral Breakdown; Source CipherBio, August 2020

Figure 2 demonstrates that most of the prospects are located in the US, followed by Europe and Asia.

Figure 2: Prospects Across Geographies; Source CipherBio, August 2020

Many of these prospects are associated with accelerators as they build their businesses and scientific capabilities. Figure 3 represents the list of top accelerators associated with these companies, showing that more than 1,200 of them have been affiliated with at least one of the top accelerators – where JLABS is the most notable one with 394 companies, followed by Startup Health (246) and Y Combinator (181).

Figure 3: Prospects Across Top Accelerators; Source CipherBio, August 2020

Looking by the top 10 approaches, the Prospect Insights data shows that by far, the largest presence is achieved by the Artificial Intelligence approach with 212 companies following this route. Other indications – small molecule, oncology and drug discovery and – follow with roughly a third to quarter the AI’s size, while medical device, Machine Learning, digital health and gene therapy are at the bottom with the lowest company count (Figure 6).

Figure 4: Prospects Across Top 10 Approaches; Source CipherBio, August 2020

Register for a free CipherBio account to find exclusive life science industry insights.

Cancers and other neoplasms clearly dominate the indication space with as much as triple the company count compared to the second biggest indication, which is Alzheimer’s disease with 43 companies (Figure 5). Parkinson’s disease also has a notable presence as it closely follows with 31 companies working in this subspace. Other top 10 indications include Autoimmune diseases (22), Stroke (19), Neurodegenerative Disease (19), Diabetes Mellitus (16), COVID19 (16), Diabetes (15) and Chronic Pain (15).

Figure 5: Prospects Across Top 10 Indications; Source CipherBio, August 2020

The biggest power of the CipherBio Prospect Insights tool lies in its interactivity and ability for investors to combine search criteria to drill down to customized specifics. So instead of giving VCs an opportunity to see all prospects by sectors, location, affiliation with top accelerators, approaches and indications separately, the CipherBio database allows them to apply all — or some — of these criteria simultaneously to arrive at highly customized search results that will select prospects that meet their specific criteria with laser precision.

For example, by clicking on the Biotech bar depicted in Figure 3, VCs can see how many of the 1898 Biotech prospects are affiliated with each of the 11 major accelerators. Moreover, they can go further into analysis by selecting accelerators, approaches and indications that they want to dive deeper into and get the list of all the prospects that satisfy the search criteria.

Figure 6 gives the complete list of prospects listed in alphabetical order together with their relevant details, which investors can explore in its entirety when they scroll down using the sidebar. However, VCs are also allowed to build their individual private shortlist of the prospects that are of most interest to them. This means that in addition to the general prospect list that includes all prospects in the database, VCs have private access to their own proprietary lists containing prospects that meet their own specific selection criteria they use to shortlist, select, monitor and watch new companies.

Figure 6: Prospects List in Alphabetical Order; Source CipherBio, August 2020

As an interactive tool, the prospect list allows VCs to proceed to the main profile page of each listed company, where they can explore the company in more detail. The following section will explain how they do that.

How Investors Drill Down Prospect Information on the CipherBio Platform

VCs are searching the CipherBio database looking to discover companies like T3 Pharmaceuticals, GentiBio and Artiva Biotherapeutics before they graduate from the prospect list and raise early-stage capital. The three companies have done that recently — unhindered by the weight of this challenging time, they went on to successfully raise Seed and Series A rounds over the past six weeks.

To illustrate the power of the CipherBio company profile, we will use these companies to showcase the functionalities that VCs use when they drill down on the prospects they shortlisted in their proprietary dashboards.

Figure 7: T3 Pharmaceuticals Profile Page on CipherBio Platform

Figure 7 represents the main profile page of T3 Pharmaceuticals, a Swiss Biotech developing cancer treatments using live bacteria which in July 2020 raised a $27M Series A round led by Boehringer Ingelheim Venture Fund and joined by Reference Capital and Wille Finance. The T3 Pharmaceuticals’ profile includes the network at the left which summarizes data pulled from the whole of the database revealing how this company is connected across the entirety of the life science board: all its investors (represented with $ sign), approach tags (atom sign) and indications (+ sign).

These networks are clearly different for GentiBio, an early stage biotherapeutics company founded in 2020 which got to raise a remarkable $20M Seed round only a week ago from OrbiMed, Novartis Venture Fund and RA Capital Management (Figure 8) as well as for Artiva Biotherapeutics, a cancer treatment biotech launched in June 2020 with a staggering $78M Series A led by 5AM Ventures, venBio Partners and RA Capital Management (Figure 9) as these companies have different approaches, indications as well as investors and partners.

Figure 8: GentiBio; Source: CipherBio Platform, August 2020

Figure 8: GentiBio; Source: CipherBio Platform, August 2020

Still, where the CipherBio really shines is with the interactivity of the visual dashboard, which means that investors can choose to dive deeper into every one of these subspaces within the network and drill down to all other companies active under the same approach tag and indication, all other companies that raised capital from the same investors or supported by the same accelerator(s).

Each individual node in the network is interactive, allowing users to move through the complexity of the network. For example, investors can easily go to the main page of another node, which enables them to start a new discovery process for the new node, clearly depicting where that new entity fits in the entirety of the life science ecosystem and revealing whom it collaborates with or competes against. In this way, even if investors don’t search for your company specifically, the powerful search engine will help your company emerge from the pool of more than 4,000 prospects represented on the CipherBio data platform as investors mine the database and move around this vast data pool. To see other ways CipherBio can help you, make sure you visit The Entrepreneur Journey on the CipherBio blog.

What This Means for Life Science Prospects: Next Steps to Increase the Chances for Funding

Fundraising is tough, but there are tools that can make life easier for companies. What we presented in this article are the real-life examples of how investors are using the CipherBio Prospect Insights, a tool built as a response to the VCs’ demand and developed according to their own specific requirements, to identify new life science investment opportunities, keep track of interesting life science companies and source new deals.

Prospect Insights tool helps life science prospects gain visibility as it puts them in front of investors that they seek to impress – those that are actively looking for the next life science company to invest in. When you create your company’s profile with full details describing its approaches, science, investors, accelerators and other relevant information you effectively cut through the noise and get in front of VCs who are using the database with an explicit goal in mind – to source new prospects and secure the deal flow.

If you are a life science company looking to raise capital, join the platform to get your groundbreaking idea and scientific venture in front of those that will change the fate of your company and the future of health.

Join us in our effort to capture the entire life science ecosystem in our database.

We strongly believe that the availability of a high-quality database about the life sciences ecosystem increases sector efficiency and benefits every company raising capital. Thus, if you are an investor or a startup in any of the relevant industries, we would like to extend an invitation to you to join the platform and or subscribe to the CipherBio insight newsletter.

Fill out your digital profile, or update it with your company’s latest news, so that you can be a part of the data set that represents the life science ecosystem.