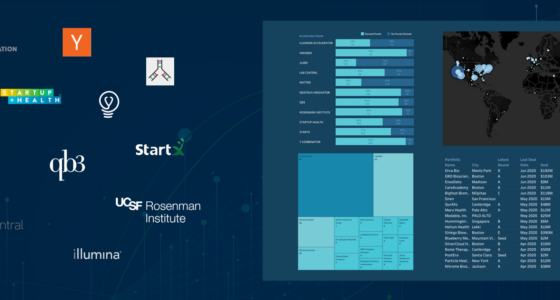

CipherBio PRO Cardiovascular Disease Insight explores the most targeted condition area for medical devices. The insight includes information on innovative cardiovascular medical device companies that received funding from 2019-2021. Since 2019, 379 VCs have invested $11.4B in 163 companies in life science cardiovascular disease medical devices. 63 of these devices are already on the market.

$11.4BInvested |

379Investors |

163Companies |

167Indications |

614Approaches |

Top Exits 2019-2021

| Company | Round | Amount |

|---|---|---|

| Acquisition | $2.8B | |

| Acquisition | $1.8B | |

| Acquisition | $510M | |

| IPO | $400M | |

| Acquisition | $375M |

Top Private Rounds 2019-2021

| Company | Round | Amount |

|---|---|---|

| Series B | $188M | |

| Series A | $155M | |

| Series C | $146M | |

| Series B | $115M | |

| Series C | $100M |

Top Accelerator: MedTech Innovator

56 companies in cardiovascular disease have raised close to a billion dollars thanks to MedTech Innovator. MedTech Innovator is the top accelerator in the cardiovascular medical device space, and 23 of their portfolio companies have ready for market products.

“Landscape analysis is critically important to key stakeholders in the medtech industry, and I was blown away by CipherBio’s new Cardiovascular Disease Insights. Strategics and venture funds are always looking to get the full picture of the cardiovascular product pipeline as are the many innovators in the space. The CipherBio Insights provides a single source to view everything in the pipeline along with indications, approaches, development stages, and it even offers the ability to download. I highly recommend CipherBio PRO to the emerging companies in MedTech Innovator’s portfolio as well as investors and large cap medtech companies. I’ve never seen anything like this.”

It was thrilling to see MedTech Innovator’s cardiovascular portfolio top the CipherBio list. If you don’t see your name on this list, you have time to apply for 2022 by Feb 15th. Apply @ medtechinnovator.org

Paul Grand, CEO @ MedTech Innovator

Top Indications in Cardiovascular Disease

The cardiovascular indication with the most companies and funding is heart failure. 35 companies have raised a combined total of $1.5 billion. Minneapolis-based CVRx Inc., which is developing Barostim™ Baroreflex Activation Therapy (BAT) for heart failure treatment has had the biggest raise. CVRX IPO’d for $144.9M in early July 2021.

| Indication | Amount |

|---|---|

| Heart Failure | $1.5B |

| Cardiac Arrhythmias | $914M |

| Heart Disease | $419M |

| Atrial Fibrillation (AF) | $365M |

| Stroke | $516M |

Most Active Investors in 2021

The VCs that invested in the most companies were Sofinnova Partners, Deerfield Management, 415 CAPITAL, Broadview Ventures, and Ascension Ventures, who invested in a total of 23 companies and participated in rounds totaling $923 Million.

Top Acquisitions in 2021

2021 saw a huge increase in funding compared to previous years. Topping the deal size list are three acquisitions: Royal Philips’s $2.8 Billion acquisition of BioTelemtry, Boston Scientific’s $1.8 Billion acquisition of Baylis Medical Company, and Haemonetics $510 Million acquisition of Cardiva Medical.

| Company | Acquirer | Deal Date | Amount |

|---|---|---|---|

| Feb 2021 | $2.8B | ||

| Jun 2021 | $1.8B | ||

| Oct 2021 | $510M | ||

| Aug 2021 | $375M | ||

| Sep 2021 | $200M | ||

| Sep 2021 | $190M |

Conclusion

With the rising prevalence of debilitating cardiovascular diseases, the demand for treatments has also risen. Fortunately, the medical device field is rapidly growing to develop life-saving, innovative treatments to combat these conditions. 100 companies in the insights remain in clinical trials, and with growing access to the FDA approval process, these smaller, private companies are able to more easily put their devices through trials with the potential to reach the market.